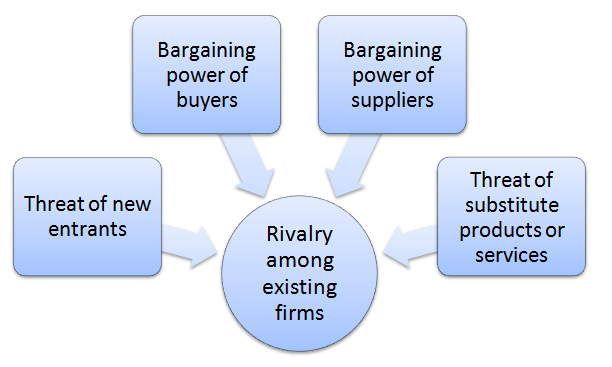

Rivalry: For most industries, the intensity of competitive rivalry is the major determinant of the competitiveness of the industry.Take transportation as an example: General Motors (GM) would view city subways as a substitute to someone buying a new car. This should not be confused with competitors’ similar products it is instead a different product that fills the same need. Threat of substitute products or services: The existence of products outside of the realm of the common product boundaries, which fulfill the same need, increases the propensity of customers to switch to alternatives.From the perspective of new entrants, high barriers to entry mean that the capital costs of getting into the industry make it difficult to compete with current incumbents. Unless the entry of new firms can be blocked by incumbents, the abnormal profit rate will tend toward zero (also known as “perfect competition”). This results in many new competitors and eventually decreases profitability for all firms in the industry. Threat of new entrants (or barriers to entry): From the view of current incumbents, profitable markets that yield high returns will attract new firms.Ideal industries will have low threats from each of these forces (i.e., low buy power, low rivalry, low risk of new entrants, etc.). In analyzing the following five factors, it is useful to rate each category as an external risk factor (i.e., low, medium, or high). A very unattractive industry would be one approaching “pure competition.” In this state, available profits for all firms are driven to normal profit rates. An “unattractive” industry is one in which the combination of the Five Forces drives down overall profitability. Industry AttractivenessĪttractiveness refers to the overall industry profitability. His list, Porter’s Five Forces, draws upon industrial organization (IO) economics to derive forces that determine the competitive intensity-and therefore attractiveness-of a market. Michael Porter, a leading business analyst and professor at Harvard Business School, has identified five key forces that affect the strategy of any industry. substitute: A replacement or stand-in for something that achieves a similar result or purpose.This model is a useful for the strategic derivation of managers it allows them to narrow down their focus on specific key issues within a given industry.Ideal industries have low threats from each of these forces (i.e., low buy power, low rivalry, low risk of new entrants, etc.). In analyzing these five factors, it is useful to rate each category as an external risk factor (i.e., low, medium, or high).Attractiveness refers to the overall industry profitability.

Porter’s Five Forces include: threat of new entrants (also know as barriers to entry), threat of substitutes, rivalry, bargaining power of suppliers, and bargaining power of buyers.

0 kommentar(er)

0 kommentar(er)